Why an organized invoice book is critical during audits

Why an organized invoice book is critical during audits

Blog Article

Checking out the Advantages of Making Use Of an invoice book for Your Small Company Purchases

Making use of an invoice book in local business transactions provides numerous advantages that can greatly influence procedures. It simplifies the paperwork process, reduces mistakes, and improves expertise. With organized financial records, organizations can manage money circulation more efficiently. As firms expand, the importance of preserving clear, structured invoicing ends up being much more vital. Several small services overlook this necessary device. What particular advantages can an invoice book supply as they navigate their distinct obstacles?

Streamlining Transaction Documents

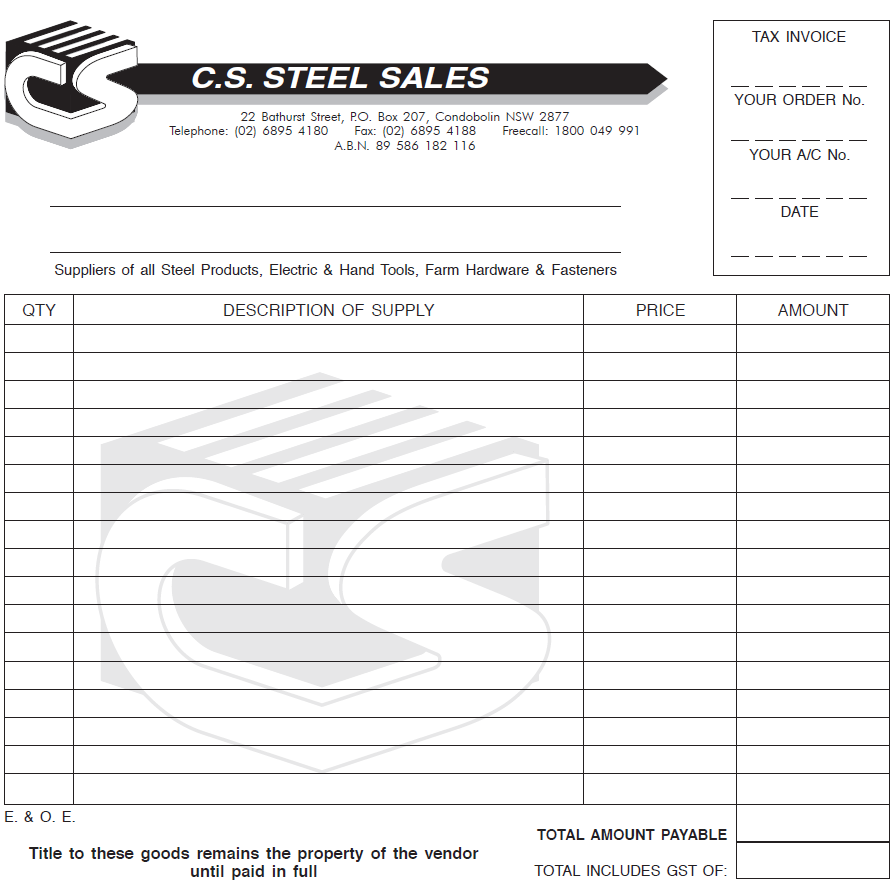

When tiny companies seek to enhance their procedures, streamlining transaction documents becomes necessary. Billing books function as a functional device in accomplishing this goal. By making use of a pre-printed invoice book, small companies can minimize the time invested in documents and reduce errors related to hand-operated access. Each billing supplies a structured design, ensuring that all essential info-- such as date, services rendered, and repayment terms-- is regularly captured.Moreover, an organized billing book permits very easy monitoring of purchases, improving record-keeping performance. This system not just helps with quicker payment however also help in preserving clear monetary documents for tax obligation functions. By adopting an invoice book, local business can develop a smooth workflow that eases the worries of transaction paperwork. Inevitably, this simplification adds to boosted functional efficiency, enabling service owners to concentrate on development and customer support instead of obtaining slowed down by management tasks.

Enhancing Professionalism and Branding

A well-designed billing book can substantially enhance a local business's professionalism and trust and branding. When clients get billings that mirror a natural brand name identity-- with consistent use logos, color pattern, and font styles-- they perceive business as even more legitimate and dependable. This interest to detail cultivates count on, encouraging repeat purchases and favorable word-of-mouth. Additionally, a well-known billing book can work as a marketing device, discreetly enhancing the firm's photo every single time a billing exists. By including a business tagline or a short summary of services, the invoice can advise customers of the company's worths and offerings.Furthermore, a professional look distinguishes a small company from competitors, making it a lot more remarkable in a crowded marketplace. Inevitably, purchasing a quality invoice book communicates commitment to quality, which can leave an enduring impact on customers and contribute to lasting business development.

Improving Capital Monitoring

Efficient capital administration is crucial for small companies to maintain financial security and growth. A billing publication works as an important tool in this procedure, enabling company owner to track sales and expenses methodically. By providing clear documents of transactions, it enables prompt follow-ups on past due settlements, which can considerably boost money flow.Additionally, having a structured invoicing system helps small company proprietors anticipate cash money flow requires, guaranteeing that they have sufficient funds to cover functional costs and unexpected expenses. The exposure that an invoice book supplies permits for far better decision-making pertaining to financial investments and resource appropriation. Additionally, it helps in recognizing trends in consumer repayment actions, which can direct future sales strategies. Ultimately, using an invoice book gears up tiny businesses with the required understandings to manage their capital efficiently, fostering long-term financial wellness.

Simplifying Accounting Processes

Simplifying Record Keeping

Efficient document keeping works as the backbone of successful small organization purchases. Making use of an invoice book simplifies this process by supplying a structured style for documenting sales and expenses. Each billing creates a tangible record, minimizing the risk of shed details and helping in the organization of financial information. Businesses can easily track payments and outstanding balances, which enhances total visibility of capital. Additionally, an invoice book reduces the time spent on management tasks, allowing owners to concentrate on core business operations. By settling documents in one area, it eliminates complication and assists in easier access of details when required, eventually simplifying the audit procedure and promoting better service management.

Enhancing Financial Precision

Accurate financial documents are crucial for small companies aiming to keep earnings and conformity. Making use of an invoice book considerably improves financial precision by giving an organized method for tracking sales and expenses. Each purchase taped in an invoice book is recorded in a constant format, reducing the likelihood of mistakes that can emerge from hand-operated entry or electronic mismanagement. This organized approach guarantees that all monetary information is arranged and easily accessible, making it less complex to cross-reference info. Additionally, the use of sequentially numbered invoices assists avoid replication and omissions. By enhancing accountancy procedures, tiny companies can guarantee that their economic details reflects true performance, inevitably supporting better decision-making and cultivating lasting sustainability.

Improving Tax Preparation

While preparing tax obligations can frequently really feel frightening for local business proprietors, using an organized billing publication can substantially streamline the process. By systematically tape-recording all purchases, an invoice book provides a clear introduction of income and expenditures, which is vital for exact tax coverage. The detailed entrances assist in simple tracking of insurance deductible costs, ensuring that company owner do not neglect possible tax obligation advantages. Additionally, having all economic records in one place reduces the time spent looking for records during tax obligation season. This structured approach not only reduces mistakes however additionally boosts general effectiveness, permitting local business proprietors to focus on their core operations as opposed to be slowed down by tax preparation issues. Inevitably, an invoice book offers as an important device in economic administration.

Enhancing Client Relationships

Efficient client connections depend upon clear interaction channels, which cultivate transparency and understanding. invoice book. By preserving professionalism and trust and building trust, services can boost their track record and client commitment. Additionally, offering tailored purchase records can develop a more tailored experience, additional strengthening these vital links

Clear Interaction Networks

Consistently establishing clear interaction channels is essential for enhancing customer connections in little organizations. Efficient interaction fosters openness blog and assurances that customers are constantly informed about their purchases. A billing publication works as a substantial device that records arrangements, repayment terms, and deal information, reducing the capacity for misunderstandings. By giving customers with efficient invoices, services can enhance quality and promote liability. In addition, regular follow-ups concerning billings can assist in open discussions, permitting customers to voice concerns or concerns. This proactive method not just develops trust fund but likewise shows a commitment to customer support. In turn, satisfied clients are more probable to return for future deals and recommend the organization to others, inevitably contributing to long-term success.

Professionalism and Depend on

Professionalism and trust and trust fund are fundamental aspects in reinforcing customer connections within small companies. Making use of an invoice book can considerably enhance the understanding of professionalism in deals. This tool offers constant and organized paperwork, guaranteeing clients receive clear and accurate invoicing info. When clients see well-structured invoices, it fosters a feeling of integrity and competence in business. Furthermore, timely invoicing can assist establish trust, as customers value transparency regarding their financial responsibilities. A specialist appearance not only shows the service's worths but likewise guarantees clients that their interests are prioritized. Utilizing an invoice book can lead to improved client contentment, repeat service, and positive referrals, ultimately contributing to the long-lasting success of the small company.

Personalized Transaction Records

An invoice book not just enhances professionalism and reliability however additionally allows for the creation of individualized purchase documents that can significantly strengthen client relationships. By recording certain details of each transaction, services can customize their solutions to satisfy specific client demands. These records enable companies to sites keep in mind customer preferences, repayment background, and previous interactions, fostering a feeling of attentiveness and care. Furthermore, tailored billings can include notes or acknowledgments, making customers really feel valued and valued. This method not just enhances consumer complete satisfaction however also motivates repeat company and referrals. In general, personalized deal records serve as a powerful tool for constructing trust and loyalty, inevitably adding to long-lasting success in a competitive market.

Assisting In Easy Record Keeping

Reliable document keeping is crucial for local business to preserve monetary wellness and enhance operations. A billing book acts as a valuable device hereof, providing a structured approach for documenting purchases. By using an invoice book, small business owners can easily track sales, payments, and outstanding balances, which assists in taking care of cash circulation efficiently.The arranged design of an invoice book streamlines the process of recording purchases, lowering the likelihood of mistakes that may emerge from digital entrance or scattered notes. The substantial nature of a physical billing book guarantees that records are always accessible for review, audits, or tax obligation preparation.This system promotes accountability, as each transaction is documented with clear details, permitting for exact document maintaining. Ultimately, an invoice book not just improves daily procedures however likewise enhances economic quality, enabling local business to make educated choices based on precise information

Sustaining Business Development and Scalability

As local business desire grow and scale, having a dependable invoicing system comes to be vital in sustaining these aspirations. An effective billing book not only enhances transaction procedures but additionally enhances expertise, which can attract new clients. By maintaining accurate records, businesses can assess capital and identify fads, permitting them to make enlightened choices about expansion.Furthermore, a well-organized invoicing system promotes compliance with tax laws, decreasing possible liabilities and releasing sources to concentrate on growth initiatives. As organizations range, the capacity to rapidly create invoices and track repayments becomes increasingly vital, ensuring that capital continues to be steady.Additionally, the historic information from an invoice book can supply understandings for future projecting, allowing services to establish realistic goals. Inevitably, using a durable invoicing system positions small companies to adapt to market needs and seize chances as they emerge, promoting lasting development.

Frequently Asked Concerns

Just how Do I Choose the Right Invoice Schedule for My Business?

Selecting the ideal billing book includes reviewing business size, regularity of deals, and details needs. Think about aspects like style, toughness, ease of see here use, and whether digital options might boost effectiveness and company in taking care of finances.

Can I Customize My Invoice Publication for Branding Purposes?

What Are the Expenses Connected With Using an invoice book?

The costs connected with making use of an invoice book typically consist of preliminary purchase rates, possible modification charges, and continuous expenses for added materials. Companies must additionally think about time purchased handling and preserving invoices properly.

Exactly how Do I Deal With Lost or Damaged Invoices?

When taking care of lost or harmed invoices, one must promptly produce duplicates and record the incident. Preserving clear records and alerting afflicted events assists guarantee openness and continuity in economic documentation and relationships.

Are There Digital Alternatives to Typical Invoice Books?

Digital choices to typical invoice publications consist of invoicing software application, mobile apps, and cloud-based systems. These options supply attributes like automation, tracking, and easy accessibility, boosting efficiency and organization for services handling their economic transactions.

Report this page